Apple beware: Chinese phones are taking over the world

For the second quarter in a row, Chinese smartphone makers produced more phones than market leaders Apple and Samsung, according to a new Q3 shipment volume report from global market research firm Trendforce.

Apple saw its iPhone volume production fall 5.3 percent from the three months previous, while Samsung registered minor growth of 1.3 percent. Chinese smartphone makers on the other hand? A quarterly increase of 18 percent.

This doesn’t quite tell the whole story, though.

On the Apple front, iPhone production totaled 45 million units in Q3. The iPhone 7 began shipping at the tail end of this period, but shipments were limited in quantity and therefore not enough to stop an overall decline on the number of iPhones manufactured.

[contextly_auto_sidebar]

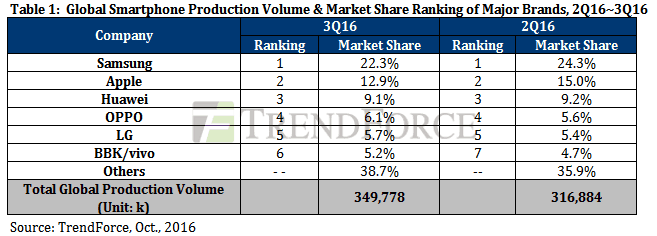

Nonetheless, Apple was the second top company in terms of smartphone production volume and market share — with 12.9 percent of the global market. This number was down slightly on the 15 percent of the previous quarter.

Samsung, meanwhile, built 78 million units — mainly thanks to the success of its Galaxy J, Galaxy S7 and S7 edge handsets. Overall, Samsung was the world leader for market share with 22.3 percent of the market. Like Apple, this number was down slightly from the 24.3 percent of the previous quarter.

Of the total 350 million smartphones manufactured worldwide, a massive 168 million handsets were manufactured by Chinese companies. Leading the list was Huawei, followed by OPPO, BBK, Lenovo, and Xiaomi.

So why is there more to the story than this? There are a few reasons. For one, volume shipments can be a misleading statistic, since it does not necessarily correlate directly with sales. More importantly, it doesn’t correlate with profit — which is notoriously hard to come by the lower you go down the smartphone food chain. Even measuring market share is non-reliable as a measure of success, since companies like Apple have never chased market share as the be-all-and-end-all metric by which to judge success.

Perhaps most notable, though, is that looking at the calendar Q3 smartphone volume leaves people on something of a cliffhanger. As noted, the iPhone 7 started shipping at the end of the quarter, but we won’t be able to see its impact until Q4. Given that reports suggest that the handset is doing better than even Apple expected, it will be interesting to see what the next three month period holds.

This is also the time in which Samsung will start to feel the effects of its disastrous Note 7 recall and subsequent halt in production. With Samsung’s reputation damaged at the top end by the Note 7 saga, and squeezed more than ever by low-cost OEMs at the other, Q4 could well see a reversal of fortunes for Apple and Samsung.