BlackBerry is losing 56,000 users a month in the U.K.

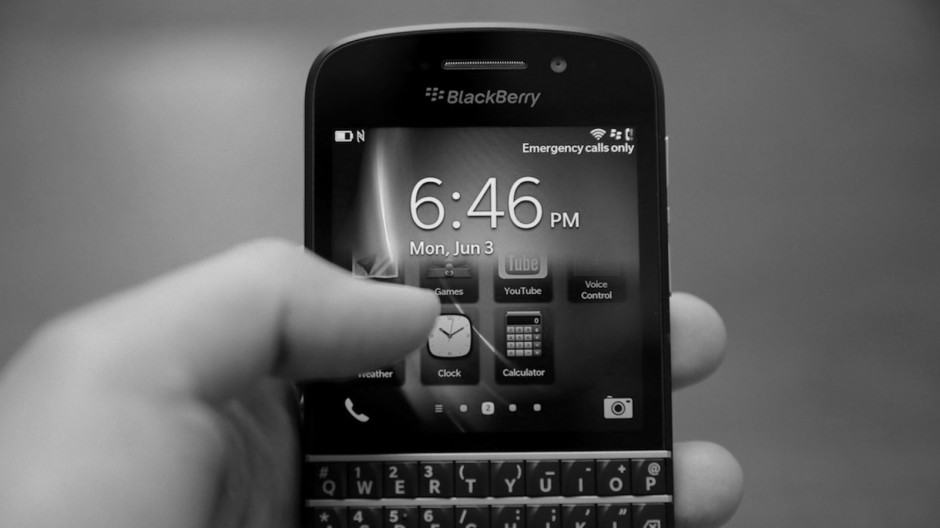

BlackBerry 10 wasn’t the savior BlackBerry hoped it would be. Photo: BlackBerry

BlackBerry’s smartphone business is imploding in a big way in the U.K., where the company is currently losing around 56,000 users every month to Android, iOS, and Windows Phone, new research shows.

Just two years ago, the Canadian company had around 8 million non-business users in the U.K., but that figure is expected to fall below 1 million by the end of this year.

The staggering collapse of what was once one of the most iconic smartphone makers follows a series of significant and expensive failures, including the PlayBook tablet, the BlackBerry 10 operating system, and the growing number of devices that run it.

Many believe the root of BlackBerry’s problems is its slow reaction to the iPhone, which was first announced in January 2007. It didn’t deliver its own all-touch operating system and devices until six years later; had they arrived sooner, it could have been a different story.

Now BlackBerry’s business looks unhealthy in most markets, but the company is losing customers at a momentous rate in the U.K., where its smartphones were once so popular — not only among business users who needed a physical keyboard, but also teens addicted to BBM.

Based on new research from eMarketer, The Guardian reports that BlackBerry may have as few as 700,000 non-business customers in the U.K., and that figure could drop to 400,000 by 2017.

Additional data from Kantar Worldpanel suggests BlackBerry is still clinging onto 1.4 million non-business users, but it is losing a whopping 56,000 every single month to rival platforms like Android, iOS, and Windows Phone.

“I’d expect we would see fewer than a million people with a BlackBerry as their primary handset around September 2015,” Dominic Sunnebo, global consumer insight director at Kantar, told The Guardian’s Charles Arthur.

BlackBerry shows no sign of changing its business model to turn this around, either. In fact, CEO John Chen, who replaced Thorsten Heins in November 2013, has made it clear that he will make enterprise customers the focus for BlackBerry’s upcoming devices.

But that, too, seems a risky move. Apple and Samsung are slowly but surely working their way into enterprise with increasingly secure Android and iOS devices, and several high-profile companies have already dropped their BlackBerry devices in favor of the alternatives.

eMarketer data shows that Android now accounts for 56.2% of smartphones used in the U.K., which translates into around 21.5 million users. Apple has around 13.4 million users and a 38.1% share of the market, while Windows Phone holds 3.3 million with an 8.5% share.

BlackBerry’s less than 1 million users gives it a 1.9% share.

- SourceThe Guardian