Apple and Samsung are tied as world’s top smartphone vendors

Samsung and Apple are evenly matched. Kind of.

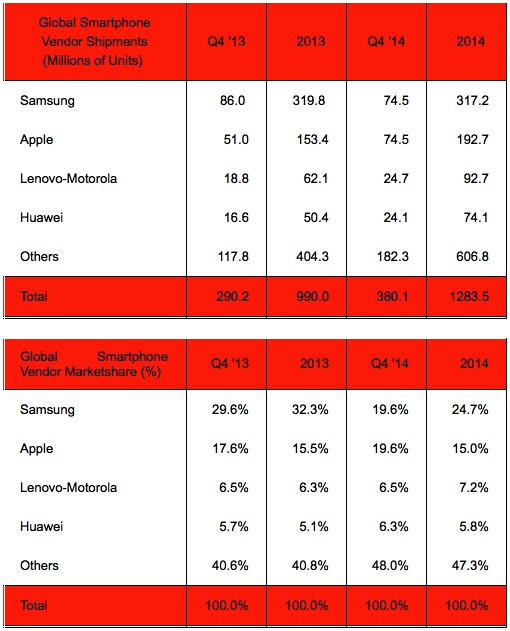

Apple and Samsung were dead even when it came to worldwide smartphone sales in the last three months of 2014, with each company selling 74.5 million handsets around the globe to capture a shade under 20 percent of the total marketshare.

For those keeping track at home, the last time the two were tied so evenly was Q4 2011 — shortly following the death of Apple co-founder Steve Jobs, and just after Tim Cook took over as CEO.

Photo: Strategy Analytics

After Apple and Samsung, Lenovo and Huawei came third and fourth place when it comes to sales, with 6.5 percent and 6.3 percent of the market respectively. After that, every other company scrapped it out for the remaining 48 percent of users.

On paper at least, Samsung is the year’s winner — having sold a larger number of smartphones prior to Apple’s final iPhone 6-fueled dash at the year’s close. However, looks can be deceptive, as there’s no doubt Samsung struggled considerably in 2014 — as flagging mobile sales and an inflated sense of demand for its products hit the company hard.

Interestingly, when everything is taken into account, in 2014 Samsung saw its first annual profit decline since 2011: when it first took over from Apple as the leading smartphone vendor. Of course, those 2011 days weren’t so good for Samsung, either. A quick peak back in the record books shows how Apple managed to squeeze 51 percent of smartphone profits that year, while Samsung eked out a measly 15 percent.

Update: The IDC has released its report this morning, confirming Apple and Samsung are neck and neck in the smartphone battle. While everyone was worried about how low cost Android OEMs would affect the iPhone’s growth, it’s actually been Samsung that’s taken all the damage.

“Having spent 11 quarters prior to 4Q14 as the number two smartphone vendor in terms of shipments, Apple managed to close the gap to a near tie with Samsung in 4Q14. Led by the success of its newer, larger iPhone 6/6+ models, Apple reduced the volume gap to just 600,000 units in the fourth quarter.

Continued success from Apple, coupled with the ongoing challenges facing Samsung, could enable Apple to overtake Samsung during the 2015 calendar year. Samsung’s challenges have not only come from Apple, but also from the increasing number of low-cost Android OEMs that are putting out products at much lower margins.

Samsung’s faced with two options: join Xiaomi and OnePlus in the race to the bottom with cheap, low margin handsets, or compete strictly with Apple on the high-end. We expect to see Samsung’s answer next month at Mobile World Congress where it’s rumored the company will reveal the Galaxy S6.

Source: Strategy Analytics