Isis Mobile Wallet To Take On Google Wallet This Summer, Announces First Banking Partners

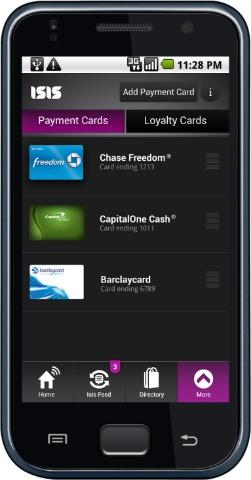

The heavily backed Isis mobile payment system is set to take on Google Wallet this summer and will be available to 100 Million U.S. cardholders. Chase, Capital One and Barclaycard have all signed on with Isis to enable their credit, debit and prepaid cards to be placed into the Isis Mobile Wallet. Isis is a joint venture created by AT&T, T-Mobile and Verizon Wireless and is the reason why Google Wallet was blocked on the Verizon Galaxy Nexus (which is anti-competitive IMO but we have a fix for that).

Google Wallet is definitely up against some stiff competition but it’s a large market with plenty of potential customers so I’m sure they’re not worried. Mobile payment systems use Near Field Communications to allow consumers to make payments, redeem coupons and loyalty perks, all without the need to carry around multiple cards. It’s a nice convenience and I’ve been using Google Wallet without any issues for a bit now. The biggest fear for consumers will of course be security but consumers will be afforded the same protections on mobile payments as they are should their actual cards fall into the wrong hands. For more information about Isis and their mobile payment system, check out the press release below.

Chase, Capital One and Barclaycard First to Place Their Cards in the Isis(TM) Mobile Wallet

Starting This Summer, the Isis Mobile Wallet Will Be Available to More Than 100 Million U.S. Card Holders

BARCELONA, Spain, Feb 27, 2012 (BUSINESS WIRE) — Isis(TM), the mobile commerce joint venture created by AT&T Mobility, T-Mobile USA and Verizon Wireless, today announced that Chase, Capital One and Barclaycard have entered into agreements with Isis enabling their credit, debit and prepaid cards to be placed into the Isis Mobile Wallet. Starting in mid-2012, consumers will be able to load their eligible Chase, Capital One and Barclaycard cards into their Isis Mobile Wallet and shop at participating merchants, starting with locations across Salt Lake City and Austin, Texas.

“Today’s announcement is testament to the vision and commitment of Chase, Capital One and Barclaycard to make mobile commerce a real and positive experience for their customers,” said Michael Abbott, CEO, Isis. “Mobile commerce is more than a new way to pay; it’s about extending the relationships consumers enjoy with their banks and merchants into a powerful and convenient new form factor.”

The Isis Mobile Wallet will provide consumers with a convenient and secure way to pay, redeem coupons and present loyalty credentials, all with the tap of their phone. Chase, Capital One and Barclaycard will tailor their cardholder service experience within the Isis Mobile Wallet to reflect their respective brands and ensure a seamless and secure experience across physical cards and mobile platforms.

“Chase is committed to making mobile commerce a reality,” said Richard Quigley, president, Chase Card Services. “By working with Isis, we are excited to help pave the way for innovation in the mobile payments space and to provide cardmembers with a secure option for easier and faster payments on the go.”

Last July, Isis announced relationships with the top four U.S. payment networks: Visa, MasterCard, Discover and American Express. Isis’ relationship with the four U.S. payment networks provides banks with the freedom to enable any major network payment card and provide consumers with ubiquity and freedom of choice when deciding which of those cards to load into their Isis Mobile Wallet.

“Our customers have embraced digital and mobile banking and are demanding new and easier ways to manage their financial lives,” said Jack Forestell, executive vice president, Digital, Capital One. “Our relationship with Isis creates an exciting opportunity for our customers to begin to fully experience the power of mobile commerce.”

Today’s announcement underscores Isis’ inclusive approach, providing all stakeholders — banks, merchants and consumers — with the freedom and choice necessary to foster a robust new industry. Isis is building an ecosystem to provide consumers with a ubiquitous and positive experience across all participating carriers, phone models, payment networks, merchants and banks.

“We believe Isis is strongly positioned to bring the convenience, value and simplicity of mobile commerce to consumers,” said Stewart Holmes, senior director-mobile commerce strategy, Barclaycard US. “We’re excited to build this offering for customers and our card partners with Isis and look forward to shaping the future of payments.”

The Isis Mobile Wallet will initially launch in Salt Lake City and Austin in mid-2012 and is planning a national rollout to follow.

“While mobile wallets may look and smell the same from afar, Isis is setting itself apart by patiently building an ecosystem of issuer, network and merchant partners, offering an open platform that leaves partners in control of how they will communicate with their customers, and leaving the partners in control of sensitive payment and marketing data transiting over the platform,” says Gwenn Bezard, research director with Aite Group. “Isis’ new announcement sends a clear signal: it is serious about scaling mobile payments.”

About Isis

The joint venture is between AT&T Mobility LLC, T-Mobile USA and Verizon Wireless and is based in New York City. The venture is chartered with building Isis(TM), a national mobile commerce venture that will fundamentally transform how people shop, pay and save. The Isis(TM) mobile commerce network will be available to all merchants, banks, payment networks and mobile carriers. ISIS is a trademark of JVL Ventures, LLC in the U.S. and/or other countries. Other logos, product and company names mentioned herein may be the trademarks of their respective owners.

www.paywithisis.com

- SourceAndroid Central